Will Red Sea Crisis clobber global economy? To fix not to fight

The continuous attacks of Iranian-backed Houthi rebels on commercial vessels and the U.S. Navy risk spillover, threatening maritime security and vitally important trade routes, namely the Suez Canal that links one global corner to another. In the wake of the Israel-Hamas war, the regional balance of power shifted, making the region even more volatile with the involvement of numerous non-state actors in armed clashes.

Hence, Yemen-based Houthi rebels' continuous violent attacks on international commercial vessels could snarl global supply chains and drive up the prices of manufactured goods at a crucial moment in the battle to defeat inflation.

The reason for Houthi attacks is to “take revenge for Israel’s devastating war against Palestinians in the Gaza Strip,” though the violent campaign in the Red Sea could potentially trigger a broader armed conflict. In response, the United States forged a maritime alliance with the United Kingdom (U.K.), France, Bahrain, and the Netherlands to thwart the rebels and ensure safety in the Red Sea and unhampered passage of the Suez Canal.

On January 18, US and British forces upped the stakes when they struck more than 60 Houthi targets in what President Joe Biden said was a direct response to the threat posed to the “freedom of navigation in one of the world’s most vital waterways.”

Moreover, on February 1, the U.S. forces carried out new strikes against ten drones belonging to the Iran-aligned Houthi rebels in Yemen, as well as a ground control centre. According to the reports, as a result, the U.S. hit a Houthi UAV ground control station and 10 Houthi one-way UAVs that presented an imminent threat to merchant vessels and the U.S. Navy ships in the region.

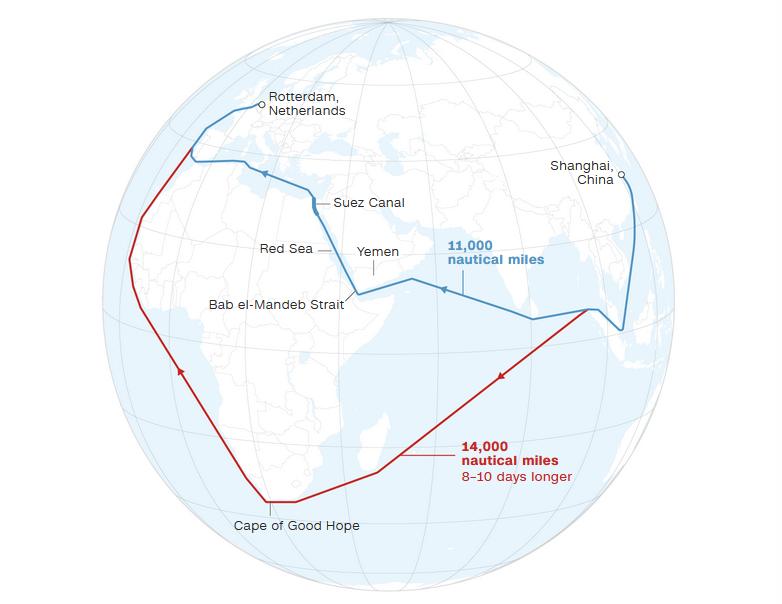

Amid attacks and US-led missile strikes, international logistic companies decided to re-route container transportation vying the Suez Canal, which highlighted another major problem for countries like Egypt. Indeed, avoiding the Suez Canal causes increased expenses in a number of ways, such as extended cargo travel distances, higher trade costs, rise in food and energy prices, and a surge in greenhouse gas emissions.

In the short term, freight going through the Suez Canal has dropped by 45% in the two months since attacks by Yemen's Houthis led shipping groups to divert freight, disrupting already strained maritime trading routes.

The Suez Canal handles 12-15% of global trade and 25-30% of container traffic. Container shipments through the canal were down 82% in the week to January 19 from early December, while for LNG, the decline was even greater. The United Nations (U.N.) report also indicates that container rates recorded their sharpest weekly increase of $500, affecting not just Asia-to-Europe shipments but also the non-Suez route to the U.S. West Coast, which has more than doubled.

The disruption of supply via the critically important route impacted oil production as the prices rose about 3% since the conflict in the Red Sea. Energy markets were already on edge after Iran seized a tanker loaded with Iraqi crude destined for Türkiye in retaliation for the confiscation last year of the same vessel and its oil by the U.S. in the Gulf of Oman on January 11.

Egypt, as the primary beneficiary of the Suez Canal operations, is now grappling with the impact of Houthi attacks in the Red Sea. Last fiscal year, the canal contributed $9.4 billion to Egypt's economy, making it a vital source of foreign exchange income.

On average, the canal generates $25-30 million for Egypt daily through shipping fees and additional services. As such, analysts say the financial impact, though limited for now, will become painful if Houthi attacks keep throttling traffic through the main maritime artery.

At the same time, traffic around the Horn of Africa increased by at least 67%, according to the International Monetary Fund (IMF). In response, the Egyptian government quickly reacted to the crisis by hiking the transit fees up to 15% to compensate for losses that entered into force in January 2024.

Revenue loss from a lack of transit traffic in the Suez Canal hits Egypt when it is already fighting numerous symptoms of economic crisis as it has struggled with flagging natural gas exports, less tourism, and dwindling remittances from ex-pats working abroad.

With the ongoing US-Houthi clashes in the Red Sea, global shipping capacity will be constrained for a while yet. As a result, many regional countries in the close vicinity will face economic backlash and security fragmentation, triggering a security vacuum. The broad impacts of the Israel-Hamas war will further hamper the volatile Middle East region.