Azerbaijan – United Kingdom: From "Contract of the Century" to "green" future Caliber.Az review

For several decades, the United Kingdom has been a key partner in Azerbaijan’s trade, economic, and investment landscape. This strong relationship is reflected in the fact that British companies have accounted for more than one-third of all foreign investment in Azerbaijan over the past 30 years.

Moreover, in addition to the traditional oil and gas sector, British and Azerbaijani businesses are now focused on expanding trade, cooperating in the field of green energy, developing the hydrogen segment, infrastructure projects, IT technologies, and more. These new priorities were discussed in London on the eve of the 7th meeting of the Joint Intergovernmental Commission (IGC) on Economic Cooperation.

Since gaining its state independence, Azerbaijan’s relations with the United Kingdom have evolved from mutually beneficial business cooperation to the level of strategic partnership. Since the signing of the "Contract of the Century" in 1994, nearly all major milestones in the development of Azerbaijan’s extractive industry, energy sector, and oil and gas transportation infrastructure have been closely linked to the active involvement of British businesses.

The leading role in this partnership belongs to the multinational oil and gas giant with British capital – bp (British Petroleum). The company is at the forefront of major energy projects in Azerbaijan, acting as the operator of the offshore oil fields Azeri-Chirag-Gunashli (ACG) and the gas condensate field Shah Deniz. It also holds equity stakes in the Baku-Tbilisi-Ceyhan (BTC) oil pipeline and gas export pipelines, and has a 20% share in the Southern Gas Corridor (SGC) consortium.

Over the past three decades, investments by bp and its affiliated international companies in these projects have exceeded $85 billion. At the same time, numerous UK-based service, engineering, consulting, financial, and other firms have been engaged through subcontracting in a range of other energy and pipeline infrastructure projects.

Notably, following the signing of the second “Contract of the Century” in Baku on 14 September 2017—which extended the development of the ACG block until 2050—the investment component was increased by an additional $43 billion. British capital continues to dominate these projects, which are expected to yield more than 500 million tonnes of oil and condensate. The share of the project’s operator, bp, currently stands at 30.37%.

At the same time, bp has expressed readiness to participate in the implementation of new offshore projects in Azerbaijan. In September 2024, the company signed a memorandum of understanding with SOCAR regarding the Karabakh field, and discussions are currently underway concerning its potential entry into the existing development agreement for the field. The leading British investor is also exploring opportunities to join the Dan Ulduzu-Ashrafi-Aypara project located in the Azerbaijani sector of the Caspian Sea.

Alongside traditional energy, in recent years business circles in the United Kingdom have shown a growing readiness to diversify their investments in Azerbaijan. These now include renewable energy sources (RES), green hydrogen production, startups and IT technologies, agri-processing, and tourism, as both countries intensify efforts to expand bilateral trade.

In particular, bp is cooperating with Azerbaijan’s Ministry of Energy on a project to build a 240 MW solar power plant in Jabrayil. The company has also developed a master plan for the decarbonisation of Azerbaijan’s energy sector, aimed at creating integrated green energy and transport systems, constructing energy-efficient buildings, improving waste management, and developing zero-waste industries, among other goals.

Leading British companies bp and KBR are also involved in offshore wind energy research and exploring opportunities for the production and export of hydrogen fuel in Azerbaijan. Meanwhile, bp-Azerbaijan and several UK-based high-tech firms are supporting the development of the country’s startup ecosystem and are examining opportunities to participate in IT projects and implement Industry 4.0 solutions.

Many of these areas of cooperation were discussed during the fifth session of the Intergovernmental Commission held in London in 2022 and the sixth session in Baku in December 2023.

The new priorities of bilateral cooperation were once again brought into focus during the latest session of the Joint Intergovernmental Commission on Economic Cooperation, which convened in London. A delegation representing around 30 Azerbaijani state institutions, headed by Minister of Energy Parviz Shahbazov, travelled to the UK capital to take part in the 7th meeting of the commission.

“Today’s deals with Azerbaijan will allow for an even closer working relationship between our two nations. Our Plan for Change to drive economic growth is at the heart of these agreements, boosting exports and services across the energy, infrastructure, and education sectors. Azerbaijan has for decades been a key partner for many of the UK’s sectors, and these deals will solidify that for years to come,” said Gareth Thomas, the UK’s Minister for Small Business, Services and Exports and Co-Chair of the Commission, summarising the outcome of the meeting.

According to information provided to Caliber.Az by Azerbaijan’s Ministry of Energy, Parviz Shahbazov highlighted the significance of relations with the UK, which remains the largest foreign investor in Azerbaijan’s economy, with over $37 billion in British FDI. He noted that more than 500 UK companies are currently operating in the country, and that bilateral trade turnover is showing a marked increase.

The Minister also underlined the special contribution of bp to Azerbaijan’s oil and gas industry and its growing role in “green” initiatives—particularly the upcoming construction of the “Shafag” solar power plant.

According to the Ministry of Energy, the Joint Intergovernmental Commission meeting covered cooperation in more than 20 areas, including the energy transition, green energy interconnector projects, a hydrogen strategy, as well as broader themes such as economic modernisation and diversification, infrastructure development, and improving the business environment. Baku and London have also expressed readiness to deepen cooperation in transport, the textile industry, water resource management, digital construction, aviation, and de-mining. Special attention was given to simplifying export procedures and enhancing collaboration with industrial zones, particularly the Alat Free Economic Zone.

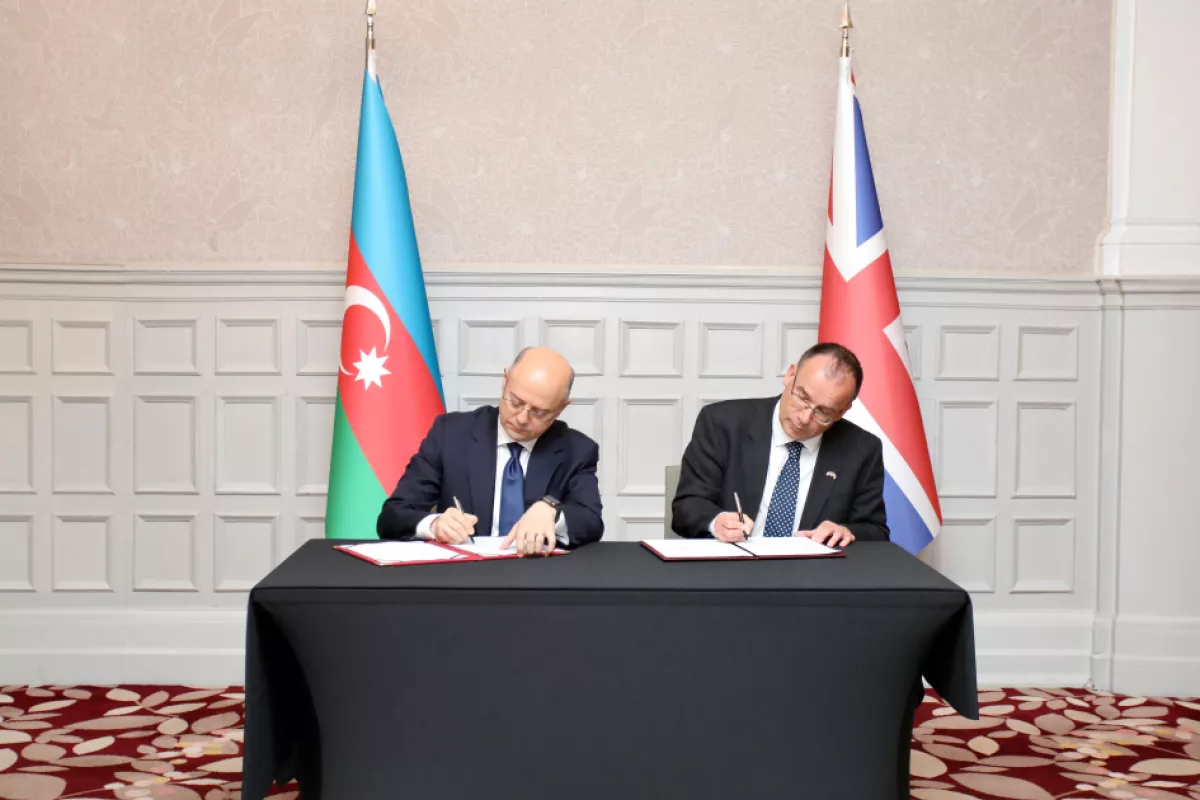

Meanwhile, Azerbaijan’s Ministry of Economy informed Caliber.Az that a Memorandum of Understanding was signed between the UK’s export credit agency (UKEF) and AZPROMO, Azerbaijan’s Export and Investment Promotion Agency, aimed at expanding mutual cooperation. The implementation of this agreement is expected to boost joint efforts in strengthening business ties and supporting major investment projects.

It was also noted that one of the key advantages of the memorandum lies in the availability of a £5 billion credit guarantee from UKEF, earmarked for the implementation of priority projects in energy, transport, and infrastructure.

The potential of credit guarantees and financing for joint projects is expected to be in high demand, given the accelerating momentum of trade and economic ties between the two countries. According to data from the State Customs Committee of Azerbaijan (SCC), trade turnover between Azerbaijan and the United Kingdom reached $323.3 million in January–March 2025, representing a 4.3-fold increase compared to the same period last year. This placed the UK 6th among Azerbaijan’s largest trading partners for the reporting period.

Notably, Azerbaijani exports to the UK surged by a factor of 5.9, exceeding $74.59 million in Q1 2025. The bulk of this consisted of 130,600 tonnes of crude oil and petroleum products derived from bituminous materials. At the same time, the share of non-oil exports in Azerbaijan’s overall trade structure with the UK has been steadily growing in recent years. This includes nitrogen-based fertilisers, food products, as well as goods produced by local industrial clusters.

British businesses operating in Azerbaijan are actively engaged in contracting and investment projects outside the oil sector. They have a strong presence in banking, insurance, consulting, brokerage, and legal services, while offices of leading UK transport, architecture, technology, service, and agricultural companies also operate in Baku.

Conversely, a significant number of Azerbaijani companies—mainly registered in London—are involved in financial and intermediary services. Azerbaijani investments in the UK economy have now exceeded $2 billion.