Media: European defence stocks surge as Trump signals stronger support for Ukraine

European defence stocks rallied sharply, continuing a robust upward trajectory this year, after US President Donald Trump made a sudden and unexpected shift in tone regarding the war in Ukraine.

Trump’s remarks, suggesting that Ukraine could reclaim all of its Russian-occupied territory, sent a clear signal to markets that Western military backing may not wane anytime soon, Reuters reports.

Writing on Truth Social shortly after meeting Ukrainian President Volodymyr Zelenskyy on the sidelines of the United Nations General Assembly in New York, Trump urged Kyiv to act swiftly, citing Russia’s mounting economic difficulties. This marked a notable departure from his earlier rhetoric, which had suggested Ukraine might consider ceding territory to secure peace with Moscow.

“On Ukraine winning back its territory seems a notable shift from only a few weeks ago when he was set on doing land deal with Putin without Ukraine. This alone is a significant shift in the optics and could indicate war goes on longer (and) US support for NATO is solid,” said Neil Wilson, UK Investor Strategist at Saxo Markets.

“At the same time, the rising tensions between NATO and Russia are a clear trigger for defence stocks to be bid,” he added.

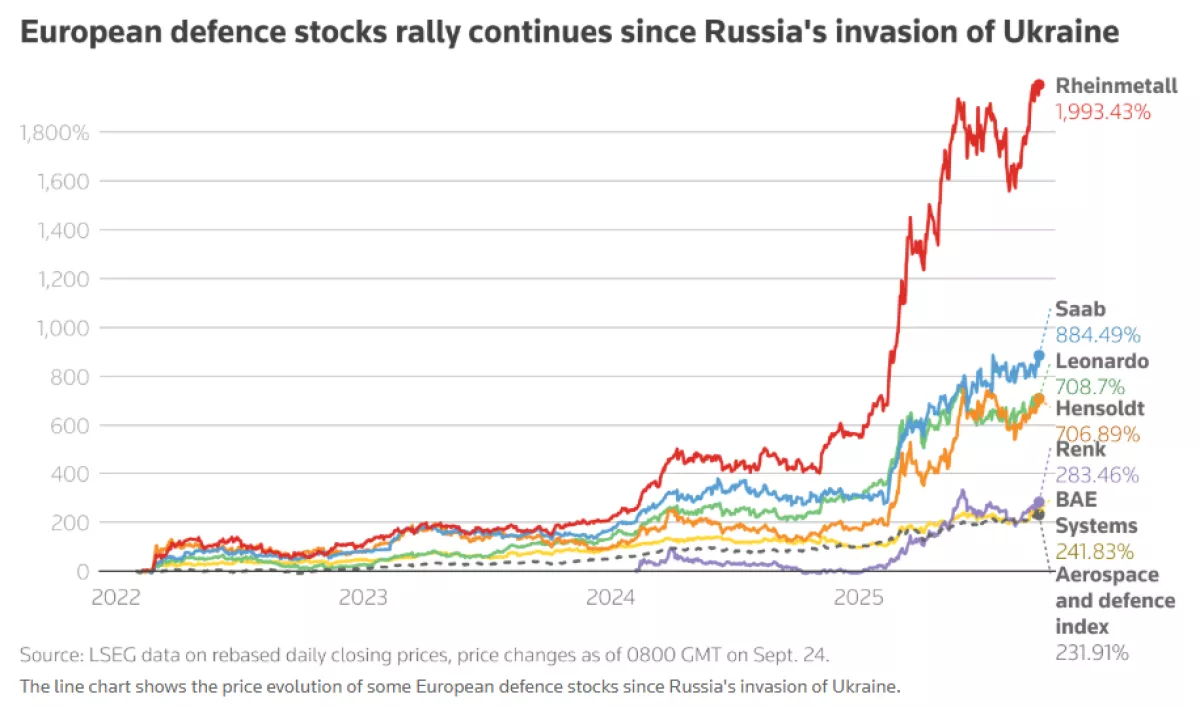

The defence index has now risen more than 200% since Russia launched its full-scale invasion of Ukraine in February 2022.

The renewed market optimism surrounding defence equities was further buoyed by expectations of increased government spending. In June, NATO member states pledged to allocate 3.5% of GDP to core defence spending and an additional 1.5% to broader defence-related initiatives — a significant increase from the alliance’s current 2% target, amounting to hundreds of billions of dollars annually.

“US President Trump’s about-face on Ukraine policy is bringing defence stocks into play today,” noted Jochen Stanzl, analyst at broker CMC Markets.

Further adding to the momentum was heightened concern over regional security, with Tom Guinchard of Pareto Securities referencing recent incidents such as the temporary shutdown of Norwegian and Danish airports due to drone threats.

While Trump’s latest comments have had an immediate market impact, there remains no indication that they signal an official policy shift from Washington. Notably, the Biden administration has not matched Trump’s remarks with any commitment to impose the additional sanctions on Moscow sought by President Zelenskyy during his visit to New York.

Leading European defence firms saw strong gains:

BAE Systems (BAES.L), Europe’s largest defence contractor by market capitalisation, rose 1.4%.

Rheinmetall (RHMG.DE), the continent’s biggest ammunition producer, added nearly 2%.

Saab (SAABb.ST) jumped around 5%, reaching its highest point since mid-July, bolstered by reports that Germany may be open to purchasing its GlobalEye surveillance aircraft.

Indra (IDR.MC), Spain’s defence and technology firm, gained 3%.

Hensoldt (HAGG.DE), which supplies sensor systems for the Eurofighter, climbed 4.6%.

Renk (R3NK.DE) and Italy’s Leonardo (LDOF.MI) both advanced roughly 3%.

France’s Thales (TCFP.PA) and Dassault Aviation (AM.PA) also recorded gains of between 1.6% and 1.9%.

With geopolitical tensions escalating and defence spending commitments rising, European defence equities continue to play a central role in the region’s market narrative — a trend likely to persist amid the uncertain trajectory of the Ukraine conflict.

By Vafa Guliyeva