Second lithium war - underground interests of business elites of warring parties in Ukraine Myths and facts about Ukrainian fossil resources

Recently, the theory has spread widely on social networks that one of the reasons for the outbreak of hostilities in Ukraine was not only the geopolitical aspirations of the Kremlin, but the appetites of a certain part of the Russian business elite.

Rumour One:

"Ukraine has huge gas reserves, and Russia could not allow such a strong competitor to appear on the European market."

Such a prospect, of course, could frighten anyone. After all, for a country focused on the export of hydrocarbons, this would be a huge blow. And if Ukraine has always been considered only as a transit country for Russian gas to Europe, then in the case of voluminous supplies from Ukraine, Russian gas simply - simply would not be very necessary for Europe, since Ukrainian gas would most likely have a lower cost and a shorter transportation leg with all the ensuing consequences. How is the situation really?

The editors of Caliber.az turned for clarification to Tengiz Mustafayev, an independent British expert in the field of oil and gas exploration and production, who worked in Ukraine for a long time. According to the expert, this theory has no scientific justification. Currently, there are small reserves of associated gas in the coal fields of eastern Ukraine. However, the production of such gas is expensive and stockpiles are limited. Moreover, in the conditions of war, we are not talking about the development of technology for the production of such gas at all.

Crimea was previously considered another potentially promising zone, but even before the occupation, no serious oil and gas reserves were discovered on the black sea shelf. To say unequivocally that there is no gas there and it would not be wrong, but if we take the example of Turkey, several international consortia ceased to exist, without discovering oil and gas reserves in the Turkish sector. And it wasn't until Turkey acquired an exploration vessel and drilled exploration wells itself that it was able to discover such reserves.

It is worth mentioning too that It took around 20 years for Turkey to make such a discovery In order to start gas production at the Sarykaya field, Turkey plans to invest about $10 billion today. Whether Ukraine or Russia will invest in such projects in such a difficult period is a big question.

Rumour Two:

"Lithium: another chance for Ukraine"

On a historical scale, the "Iron Age" was revolutionary for mankind, which replaced the "Bronze Age" about 3-4 thousand years ago. But our days can already be called the "century" of rare earth metals. They became the basis of all the electronics that surround us, on which, in fact, our civilization is built. Also, without rare earth metals, neither modern aviation would be possible. neither space exploration nor breakthrough medical technologies.

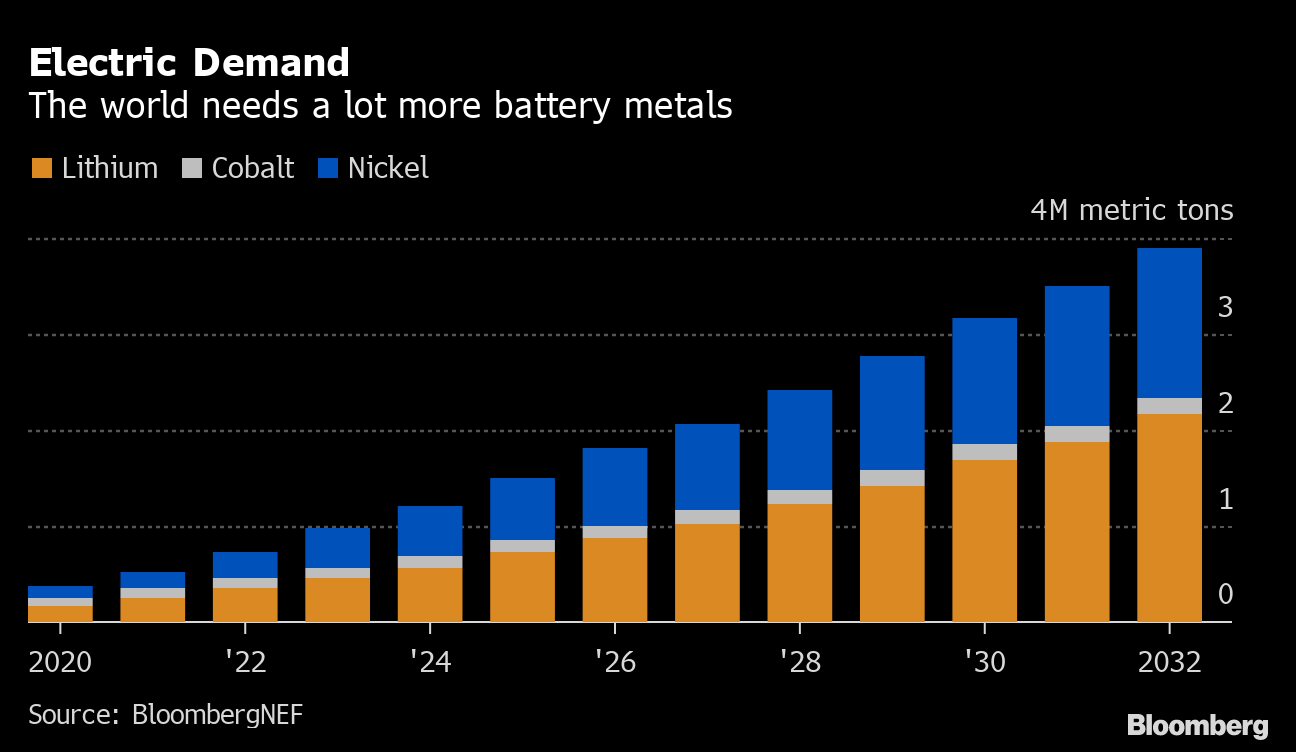

This means that in our time, countries with deposits of just such "metals of the XXI" century suddenly get a head start in the global distribution of wealth. More precisely, not just possessing, but able to establish production. The world's industry, which is rapidly moving to electric vehicles and "green" technologies, in all areas wherever possible, is in great need of copper, titanium, molybdenum, zinc, lithium, cobalt, and other metals.

There are many deposits of rare metal minerals in Ukraine. The vast majority of them have been licensed, but to date, Ukraine has not started mining copper, lithium, molybdenum and other rare metals. At the same time, it is worth paying attention primarily to lithium: over the past decade, the demand for lithium has been growing continuously.

This rare earth metal is very much in demand for the production of modern batteries, which are used both in mobile devices and electric vehicles, and in "green" energy. More than 76% of lithium production in the world falls on two countries – Australia and Chile. The main production of lithium-ion batteries is concentrated in China and Japan; there are factories in Germany, France, Canada and the USA, but they do not even come close to covering the needs of local equipment manufacturers.

In the world, 35-40 thousand tons of lithium are mined annually, and only 40% of this metal goes to the production of batteries, the rest - to the production of ceramics and glass, lubricants and to the needs of metallurgy.

Yes, batteries are the fastest growing industry that consumes lithium, and lithium production is definitely a profitable promising business. And Ukraine has significant reserves of this metal, according to preliminary estimates of the analytical agency Magonova & Partners, this is 232 thousand tons - the first place in Europe. However, specific figures and data from geological studies are classified in continuation of the "iron curtain" policy. Soviet times.

According to available information from open sources, the reserves of lithium ores at the Shevchenko deposit (Donetsk region) in category C1 are 5.7 million tons, in category C2 - more than 8 million tons.

In addition to Shevchenko, the Polokhovskoye deposit in the Kirovograd region is also of interest - the largest explored lithium deposit in Ukraine, as well as the Dobra site (Nadiya and Stankovatske ore occurrences), located in the Kirovograd region and still little studied.

On July 23, 2021, by Presidential Decree No. 306/2021, the NSDC decision was put into effect, which for the first time in the history of Ukraine approved the List of Minerals of Strategic Importance for the Sustainable Development of the Economy and the Defense Capability of the State. It contains 33 positions of basic rare metals, including lithium.

To demonstrate the reality of the announced plans, the NSDC instructed the Cabinet of Ministers to implement a pilot lithium project by the end of August this year, announcing an open investment competition for the search, mining and enrichment of lithium ore and other rare metals at the Dobra site on the terms of the production sharing agreement.

The expected investment in the project at the Dobra site with a production volume of 1 million tons of lithium ores should be at least $ 200 million, including the exploration of the deposit, the creation of production infrastructure, the construction of a mine and an enrichment plant.

The interest of its members in participating in this competition was stated in its appeals to the Ukrainian government by the U.S.-Ukraine Business Council, which includes more than 200 U.S. and other international companies.

Also, to become the first Ukrainian producer and processor of lithium, claims the public Australian company European Lithium. The main asset of the company is the Wolfsberg lithium deposit in Carinthia (Austria), production of which is scheduled to begin in 2024.

As the managing partner of Millstone & Co M. Zhernov (he is also the owner of Petro-Consulting LLC) told reporters, that in the next five years only one of the shareholders of European Lithium - the Polish Millstone & Co - will invest about $66.6 million in the Australian company. in Austria, the rest of the funds can be used to develop the Shevchenko field and the Dobra section in Ukraine.

Ukraine's lithium reserves, with the development of appropriate industries, could become the basis for the creation of new jobs and even the emergence of a whole new high-tech industry. European production of Li-ion batteries, and even based on its own raw materials, can be a very profitable business. According to experts, it takes about one billion euros to create "from scratch" factories for the production of lithium-ion and lithium-polymer batteries.

At the same time, only mass production of electric vehicles, which is now unfolding around the world, will provide a huge need for lithium batteries. And if you add to it the grandiose plans in the field of "green" energy, then the plants for the production of modern batteries are simply doomed to be profitable. With condition that they are manufactured with raw materials not "from overseas", but of local origin.

What is the global lithium market?

According to the U.S. Geological Survey, lithium resources have recently increased significantly and amount to about 86 million tons worldwide. At the same time, the largest of them are concentrated in Bolivia - 21 million tons (24.4%), Argentina - 19.3 million tons (22.4%), Chile - 9.6 million tons (11.2%), the USA - 7.9 million tons (9.2%), Australia - 6.4 million tons (7.4%) and China - 5.1 million tons (5.9%). Among European countries, the largest resources are in Germany - 2.7 million tons (3%), the Czech Republic - 1.3 million tons (1.5%), Serbia - 1.2 million tons (1.4%), Spain - 0.3 million tons (0.35%), Portugal - 0.27 million tons (0.31%).

But this is if we talk about deposits. The picture of the main miners looks somewhat different: so far about 60% of lithium production falls on Australia, 19% on Chile, 9% on China and 7% on Argentina.

Meanwhile, now world companies are actively expanding lithium production and launching new projects. For example, Canada's Rock Tech Lithium announced its intention to raise $ 400 million for the construction of a lithium hydroxide plant in East Germany. Turkey has launched a lithium plant with a capacity of 10 thousand tons per year with the prospect of increasing production to 60 thousand tons per year. The Chilean company SQM will issue shares for $ 1.1 billion to finance lithium projects - to expand capacity from 70 thousand tons to 180 thousand tons by 2023 in its own country, and also plans to launch a joint project with Wesfarmers to organize the production of lithium in Australia with a capacity of 50 thousand tons per year. Australian mining corporation Rio Tinto announced its interest in the project to develop the lithium-boron deposit Jadar in Serbia.

Demand for lithium in 2021-2023 will increase by the aggregate average annual growth rate (CAGR) by 30%, predicted in the semi-annual reporting of the Australian Bacanora Lithium PLC (it owns the Sonora project for the extraction of this metal in Mexico).

Global demand for lithium is expected to increase from 305,000 tonnes of lithium carbonate equivalent (LCE) in 2020 to 452,000 tonnes of LCE in 2021 The increase is mainly due to the fast-growing market for electric vehicles, which require lithium-ion batteries. As Bacanora Lithium notes, a strong increase in sales of electric vehicles will lead to an increase in demand for lithium to 675 thousand tons per year by 2023.

In turn, Statista predicts that the demand for lithium by 2030 will reach 1.8 million tons per year, that is, it will increase by 14 times. lithium mining company Albemarle Corporation in September this year announced that it expects an increase in global production of electric vehicles tenfold by 2030, which will ensure the growth rate of demand for CAGR for lithium to 30% per year by 2025.

The additional positive news was brought by Redwood Materials, which announced plans to build a large plant in the United States for the production of components for lithium-ion batteries. By 2030, this enterprise can provide supplies for the production of up to 5 million electric vehicles per year. This production will put an end to the debate whether there are enough raw materials and production facilities for the upcoming abandonment of personal cars with an internal combustion engine in the United States.

The increase in the price of raw materials and demand are ideal conditions for mining and processing companies, including in Ukraine. The automotive industry is capable of delivering sustained growth in lithium demand over the coming decades. The risk remains the possibility of a new type of battery that does not require lithium. However, it is unlikely that until 2030, according to experts, there will be an alternative to the lithium-ion batteries already mastered in mass production. Existing projects are mainly aimed at upgrading batteries with lithium electrodes – primarily the replacement of flammable liquid electrolyte.

Lithium based unrests (Lithium first war)

As stated above, one of the largest reserves of lithium is in Bolivia. If we recall the overthrow of Bolivian President Evo Morales at the end of 2019, at the time the "independent" press claimed that he had turned his country into a dictatorship and had just been overthrown by his own people. The Organization of American States (OAS) has released a report confirming that the elections were rigged and that democracy is being restored. However, a year later, President Morales's party won a new election with an overwhelming majority. Nobody challenged him, and he was able to triumphantly return to his country, despite the tag of "dictator", which they diligently tried to attach to him. In 2019, shortly before his ouster, Morales granted the rights to mine lithium to the Chinese company TBEA Group, which caused great discontent from the UK. Historian Mark Curtis shows that decolonization did little to change British politics. His work has been cited in dozens of articles on the Voltaire Network.

"It appears that the ouster of President Morales was a mandate from the Foreign Office and CIA cells that eluded the Trump administration. His goal was to steal the country's lithium, which the UK craves in the context of the energy transition."

Conclusion

Thus, the theory about the presence of large reserves of natural gas in Ukraine did not find its confirmation and, accordingly, this strategic product could not enter the sphere of interests of the business elites of both conflicting parties. As for lithium reserves, it is necessary to recognize both the presence of significant reserves of this raw material and its prospects from the point of view of the development of modern means of transport running on electricity. The location of the lithium deposits suggests that hostilities may be partly or completely halted after one of the parties has established its full control over them.