Europe looks to sanctioned Russia for blueprint on how to secure digital payment systems

US-based payment giants Visa, Mastercard, and PayPal dominate the cashless payment ecosystem across the European Union, with some nations—such as Ireland and the Netherlands—relying almost entirely on them. This dependency has sparked growing concern among European policymakers, especially since Donald Trump's return to power. While fears about Europe’s strategic reliance on the United States have been reignited, the Baltic states worry about possible disruptions to their payment systems from Eastern actors.

One area now under particular scrutiny is digital payments. European Central Bank (ECB) President Christine Lagarde has voiced alarm over the potential risk. The Deutsche Welle has cited Lagarde as urging Europe to "reduce vulnerabilities that arise from the current payment platform's infrastructure being foreign-owned" and ensure the availability of a "European offer — just in case."

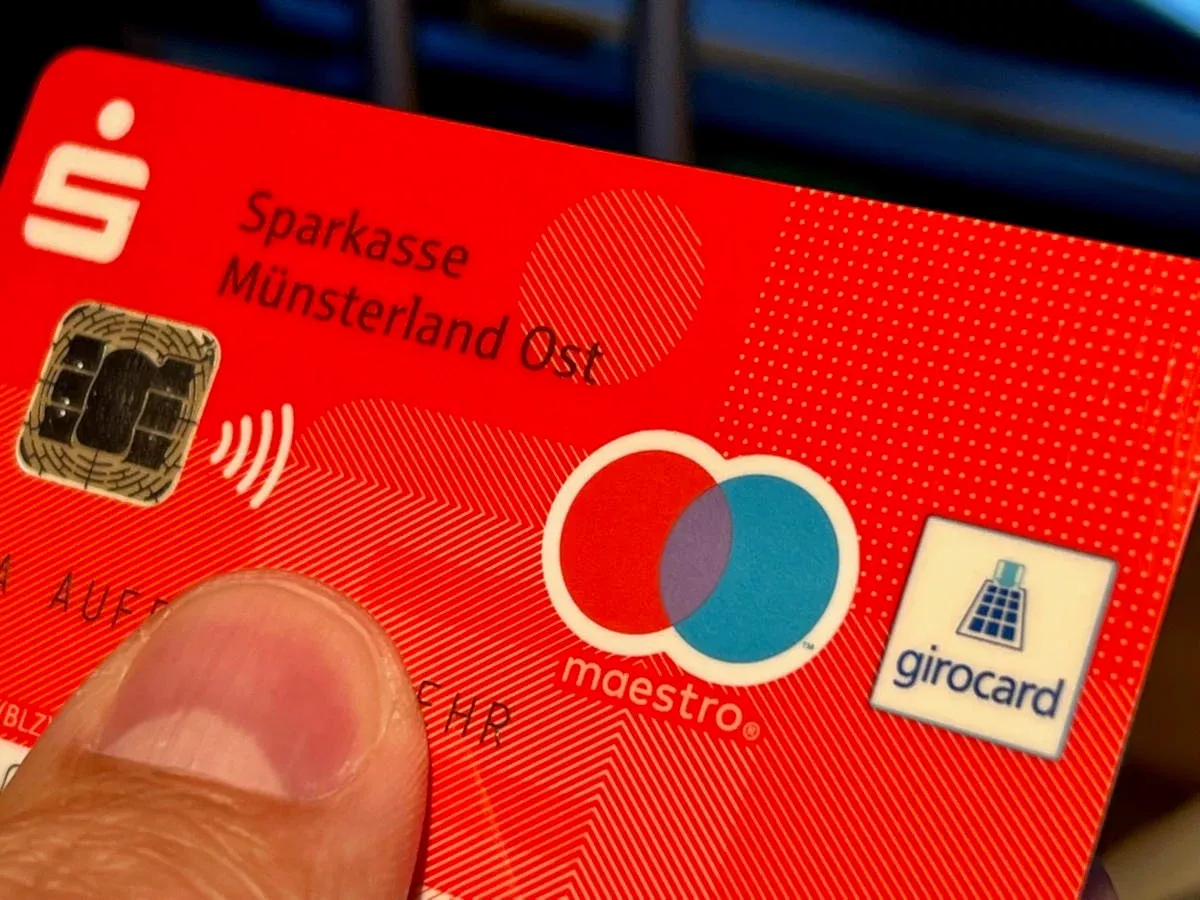

Europeans have embraced cashless transactions extensively, with ECB data showing that cards accounted for 56% of over 40 billion cashless transactions during the first half of 2024. However, reliance on US card networks varies by country. Nations like Ireland and the Netherlands are entirely dependent on Visa and Mastercard, while others such as Germany and France have developed robust domestic alternatives. Germany’s Girocard system commands over 70% of the market, and France’s Cartes Bancaires system handles nearly 80% of national card payments.

Beyond traditional cards, Europeans are also increasingly using smartphone apps to make payments—a space dominated by American tech companies. Apps like Apple Pay, Google Pay, and PayPal already handle nearly 10% of all retail transactions in Europe, according to ECB Chief Economist Philip Lane, who spoke at a March conference in Cork, Ireland. These app-based payments are growing at double-digit annual rates, further entrenching US firms in Europe’s financial infrastructure.

Restrained Russia serves as example for independence

Ironically, Russia’s response to Western sanctions on digital payments may provide a roadmap for Europe to reduce its US dependency. After the outbreak of Russian military action into Ukraine in 2022, Visa, Mastercard, American Express, and PayPal all suspended operations in Russia. But President Vladimir Putin had long anticipated this scenario and had earlier mandated that all domestic transactions be processed within Russia. This allowed Russians to continue using their domestically issued Visa and Mastercard cards—though only inside the country—because all authorization, clearing, and settlement occurred through Russian processors.

Payments consultant Hugo Godschalk suggests a similar strategy could offer Europe a short-term fix: enabling intra-EU card transactions to bypass foreign networks. This would reduce the ability of US-based companies to disrupt payments across the European bloc in times of political or economic tension.

Preparing for internet, electricity outages

Meanwhile, Lithuania is advancing its own payment resiliency strategy—though for different reasons. The Baltic country is developing an offline card payment system to ensure transactions can proceed even if internet connectivity fails. This move is driven by national security concerns, particularly their perceived potential for cyberattacks or military actions that might disrupt digital services, given Lithuania’s proximity to Russia and Belarus.

Simonas Krėpšta, a board member of the Bank of Lithuania, told the national news agency BNS that people have grown accustomed to using cards and often no longer carry cash. “Preparations are underway so that, during mobilization, if there’s no internet connection, people will still be able to pay not just with cash, but also with payment cards,” he explained. Draft legislation supporting the initiative passed its first reading in Lithuania’s parliament in April, with full implementation possible within a few months if adopted in the current session.

By Nazrin Sadigova