The vagaries of Indian blackmail Why Azerbaijan is unshaken

As recent years have shown, in today’s multipolar world, attempts by major powers to use economic leverage to twist arms and pressure business partners tend to be rather ineffective. In cases of sanctions and embargoes, commercial alternatives and new offers almost always emerge — and the party resorting to business blackmail often ends up suffering significant losses itself. This point is quite applicable to India as well, whose business circles, in light of the recent India–Pakistan conflict, have announced a trade boycott and intend to cut off tourist flows to Türkiye and Azerbaijan.

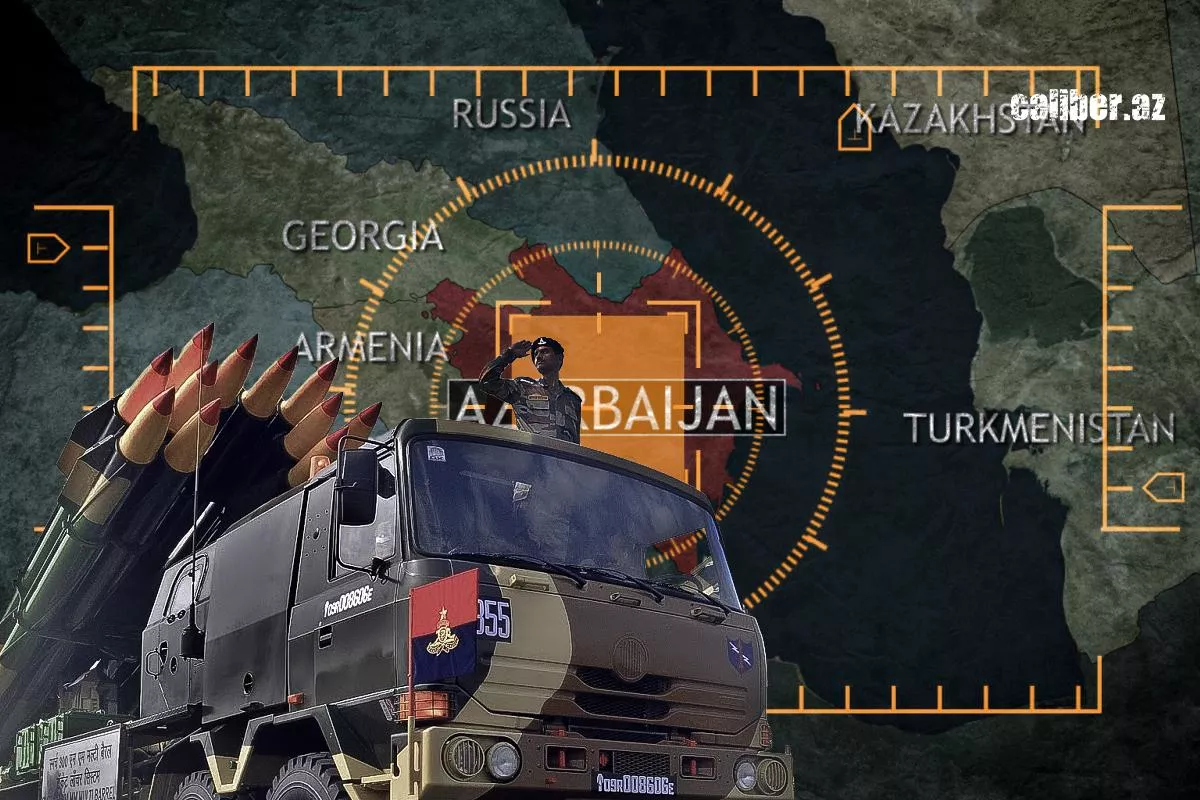

Despite challenges on the diplomatic front and New Delhi’s open support for revanchists in Yerevan, Azerbaijani-Indian business relations — including trade and tourism — have developed quite dynamically in recent years. Although Baku has consistently conveyed through diplomatic channels its messages regarding the misguided nature of India’s unfriendly actions, including the growing supply of Indian offensive weapons to Armenia, the country has not initiated any anti-Indian demarches, nor has it attempted to hinder bilateral economic ties.

Unfortunately, not all countries are guided by logic or endowed with responsibility. According to Indian media reports, over the past decade, several representatives of business circles—backed by the leadership of the Confederation of All India Traders (CAIT) as well as deputies from the ruling Bharatiya Janata Party (BJP)—have called on Indian businesses to implement a complete economic boycott of Türkiye and Azerbaijan. This is due to Baku and Ankara’s positions supporting Pakistan during the recent military conflict with India.

“A collective decision has been taken in the conference of trade leaders today to end all trade with Turkey and Azerbaijan… The reason is clear. Turkey and Azerbaijan openly supported Pakistan against India… Any import and export will not happen with Turkey and Azerbaijan with immediate effect,” said Praveen Khandelwal, a BJP deputy and General Secretary of CAIT, in a statement to journalists.

Although it is quite obvious that such statements could not have been made without the tacit approval of the country’s leadership, no direct legislative acts restricting trade have yet been adopted at the official government level. Specifically, in an official notice from India’s Ministry of Commerce and Industry dated May 2, 2025, the focus is on banning the import of products from Pakistan or goods transiting through Pakistan. There is no mention of Azerbaijan in this document.

One way or another, New Delhi’s dissatisfaction with Baku and Ankara is being channelled indirectly through business circles rather than directly. In particular, leading Indian travel companies EaseMyTrip and Ixigo have issued recommendations urging citizens to avoid travelling to Türkiye and Azerbaijan. Against this backdrop, Indian travel agencies have begun to cancel bookings en masse and suspend cooperation with Turkish and Azerbaijani hotels and tour operators: in May alone, bookings dropped by approximately 50%. Along the same lines, the Indian company Go Homestays announced it would cease cooperation with Turkish Airlines.

And here arises a reasonable question: can pressure from the Indian side significantly affect the performance of the Turkish and Azerbaijani tourism markets? In the case of the huge Turkish recreational market, the Indian embargo is practically imperceptible: in 2024, Türkiye was visited by 62.3 million foreign tourists, generating industry revenues of $61.1 billion. That same year, Turkish resorts received 330,000 Indian tourists; however, against the backdrop of overall tourist traffic, Indian travellers accounted for less than one per cent — to be precise, only 0.53%.

And how do things stand on the Azerbaijan-India tourism route, and more broadly, what potential losses might result from a decline in trade and business cooperation? It is worth recalling that in 2018, a memorandum of cooperation was signed between the tourism associations of the two countries, and an official Azerbaijani tourism office was established in the Indian city of Mumbai. That same year saw a 175% increase in tourist traffic from India.

In the following years, Azerbaijani airline AZAL and Indian carrier IndiGo established flights between Baku and Mumbai and Delhi. As a result, the flow of Indian tourists to Azerbaijan grew steadily, reaching 243,600 visitors in 2024—a 108% increase compared to the previous year. Thus, last year India ranked third after Russia and Türkiye in terms of the number of foreign travellers visiting Azerbaijan, accounting for 9.27% of the total inbound foreign tourist flow of 2.627 million people.

If India continues its confrontational rhetoric, a decline in tourist traffic this year will inevitably bring certain adjustments to the current statistics of Azerbaijan’s inbound tourism.

However, in the coming period, these losses may be more than compensated by cooperation in the tourism sector with China and Pakistan. To recall, in 2024, 80,900 tourists arrived in Azerbaijan from Pakistan, while the number of travellers from China reached 44,700 — twice as many as in the pre-pandemic period. According to the State Statistics Committee, this trend continued to accelerate in January-April 2025: the number of visitors from China increased by 1.7 times, and from Pakistan by 22.5%.

This is hardly surprising, as Baku maintains strategic partnerships with Islamabad and Beijing. Trade and business cooperation between the countries are growing dynamically, and air links between major cities have been established.

“Today, I learned that 150 million Chinese people travel abroad. In one of my meetings I said, if only 1% comes to Azerbaijan, that will be enough for us,” Azerbaijani President Ilham Aliyev recently stated in an interview with the Chinese television network CGTN (China Global Television Network).

The head of state recalled that in 2024, Azerbaijan unilaterally abolished the visa regime for Chinese citizens for the first time, and this year Chinese partners took a reciprocal step. The President of Azerbaijan noted that after the visa-free regime was introduced last year, the country welcomed nearly twice as many Chinese visitors and expressed hope that their numbers would continue to grow. He cited ongoing negotiations between the relevant agencies to increase the number of flights as a guarantee of this growth.

When examining trade and economic cooperation with India, it is important to note that its characteristics mean Azerbaijan would not suffer any irreparable losses even if the crisis in relations intensifies.

Recall that just ten years ago, in 2015, the Azerbaijan-India trade turnover amounted to $250 million, and steadily growing, it peaked during the global energy crisis in 2022 at over $1.859 billion. However, in the following two years, trade volumes noticeably declined: in 2023, it slightly exceeded $1.1 billion, and by the end of 2024, it stood at $957 million.

Special attention should be paid to the structure of the trade turnover: Azerbaijani exports last year accounted for $734 million—mainly oil and petroleum products. All of these Azerbaijani export products belong to a highly liquid category and can be easily redirected to other markets, such as Türkiye and European countries, without losses. Moreover, the Indian energy market cannot be considered high-margin, not to mention the significant delivery “distance,” which increases transportation costs.

In contrast, imports from India last year amounted to $223 million, a significant portion of which consisted of rice supplies. Notably, in the first quarter of 2025, Indian rice imports decreased by 7%. The next most significant Indian imports are pharmaceuticals, followed by clothing and textiles, food products, and to a very small extent, electronics and certain types of equipment.

If New Delhi continues its destructive trade policy, Azerbaijan can easily compensate for the needs in the mentioned product groups with supplies from Türkiye, Pakistan, China, and other countries in the Asia-Pacific region (APR).

This particularly applies to an important component of food security — rice. In 2022, Baku exempted imports of Pakistani rice from a 15% customs duty; this decision is valid until 31 December 2027 and may be extended. Agricultural companies from Pakistan plan to increase rice supplies to Azerbaijan tenfold. Moreover, recently, the Pakistani company LLC Azerbaijan Rice Processing Mill obtained resident status in the industrial park “Araz Valley Economic Zone” and plans to establish processing, sorting, and packaging of imported raw rice.

On the other hand, Türkiye, Pakistan, and China can easily compensate for supplies in the garment sector if Indian importers withdraw from the Azerbaijani market. The trade confrontation unleashed by New Delhi will lead to even greater losses in the pharmaceutical segment: today, Indian pharmaceutical companies account for approximately 5% of the total volume of medicine imports into Azerbaijan, and their market niche can be easily occupied by affordable pharmaceutical products from Pakistan.

Speaking of potential losses on the investment front, the risks facing India are significantly higher. According to information provided to Caliber.Az by the Ministry of Economy of Azerbaijan, there are currently more than 1,100 active Indian companies operating in the country. At the same time, India has invested approximately $1 billion in Azerbaijan’s economy. In contrast, Azerbaijani business investments in the Indian economy are negligible—around $4 million.

It is important to remember that while attempting to pressure Azerbaijan through economic levers, New Delhi must also consider that the Indian oil and gas company Oil and Natural Gas Corporation (ONGC) holds a 2.31% stake in the development of the Azeri-Chirag-Gunashli (ACG) oil and gas field, and last year acquired an additional 0.615% stake from the Norwegian company Equinor. At the same time, ONGC owns a 2.36% share in the Baku-Tbilisi-Ceyhan (BTC) pipeline and in 2024 further expanded its investment by purchasing 0.737% of BTC shares from the pipeline operator BTC Co.

To sum up, the trilateral strategic partnership between Azerbaijan, Türkiye, and Pakistan—in political, business, and defence spheres—forms the foundation of long-term cooperation, and this solid base remains unaffected by blackmail or economic pressure from any side.