Aviation fair underscores industry's shift towards sovereignty over alliances Singapore Airshow 2026

While the 10th edition of the Singapore Airshow, held earlier this month at the Changi Exhibition Centre, may have lacked the blockbuster, high-volume orders typically seen at events such as the Paris or Dubai airshows, the deals announced and confirmed carried strategic weight. Rather than headline-grabbing mega-contracts, this year’s transactions underscored a broader shift toward fleet modernization and strengthening regional connectivity across the Asia-Pacific.

Amid rising geopolitical uncertainty, defence buyers at the show made clear that sovereignty is becoming a top priority — from local production and co-development to ownership of the software and intellectual property that power advanced systems.

Industry executives told CNBC that control over hardware, software and supply chains is now a decisive factor in procurement decisions. Many pointed to shifting global alliances and increasingly confrontational rhetoric among major powers as key drivers of this change.

“There is a notion that is coming around very explicitly ... the notion of sovereignty,” Pascale Sourisse, senior executive vice president for international development at French aerospace and defence firm Thales, told the outlet.

According to Sourisse, this growing focus on national control has contributed to rising defence budgets, as governments conclude they must take greater responsibility for their own security.

Chua Jin Kiat, executive vice president and head of international defence business at Singapore-based ST Engineering, echoed that view. Over the past year, he said, US President Donald Trump’s combative posture toward allies has reinforced the idea that “we may not be able to depend on others.”

During the Trump administration, Washington pressed its allies to increase defence spending, with NATO members committing to allocate 5% of GDP to defence by 2035. Trump also publicly criticized allies such as Canada and, more recently, Denmark over Greenland. He reportedly remarked that the United States might sell allies downgraded versions of American weapons “because someday, maybe they’re not our allies.”

Chua suggested that countries are increasingly questioning whether traditional alliances remain as binding or relevant as before, including institutions such as NATO.

“So you can be a NATO member. But actually, at the end of the day today, what we are seeing is, first and foremost, if I’m Germany, I’m Germany. If I’m Finland, I’m Finland,” he said.

One tangible outcome of this shift is a renewed push to strengthen supply-chain resilience. Companies told CNBC they are responding by localizing manufacturing, transferring expertise and partnering with domestic firms to ensure that customers can maintain and upgrade systems without relying on extended, vulnerable supply lines.

Sourisse said Thales is pursuing localization not only in sales but also in capabilities, establishing joint laboratories in Singapore with local agencies to develop on-the-ground expertise.

For its part, ST Engineering favors co-production models abroad, given Singapore’s limited land availability for large-scale manufacturing. Chua explained that if the company can produce advanced vehicles in countries with greater industrial capacity, it would collaborate and transfer the necessary know-how under co-production arrangements.

“At the same time,” he noted, “for many of the big primes, they have to keep their factories at home running. They have got huge production plants, thousands of jobs, and the lights have to be kept on constantly.”

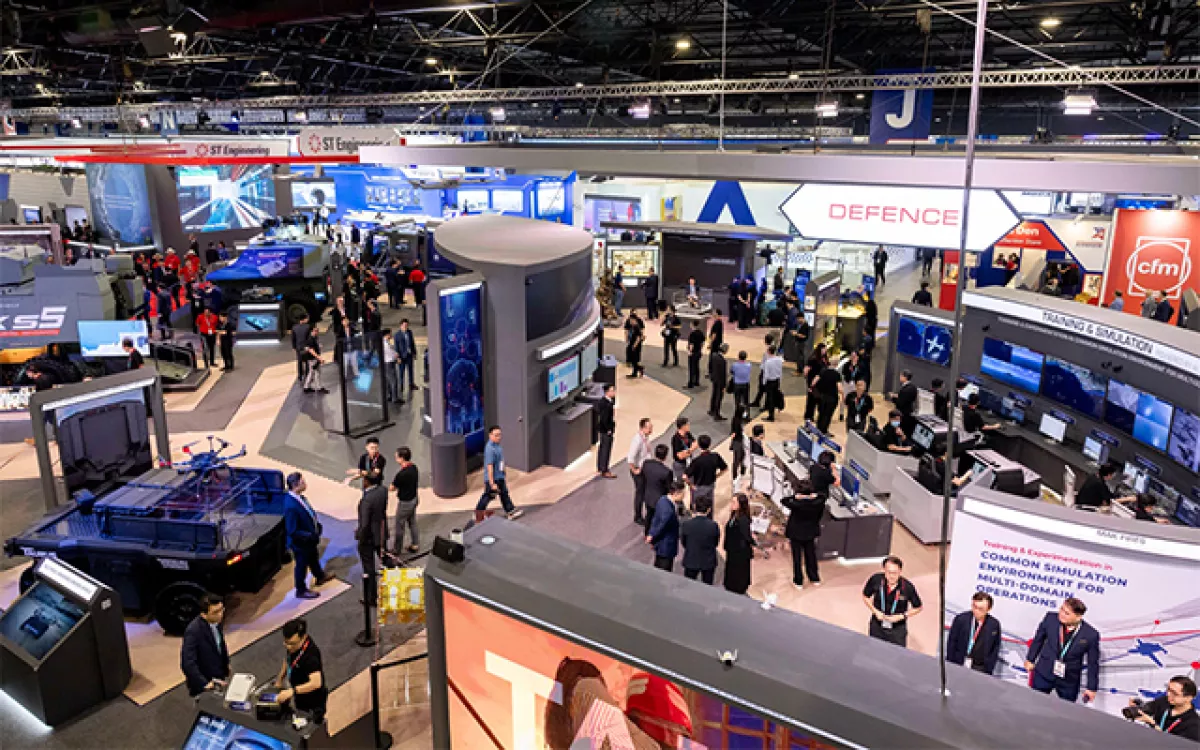

In another article written by The Diplomat, the outlet observed that unmanned systems remained a central focus of the airshow. The global UAV market is increasingly polarized. Companies such as Anduril Industries – well known for its frequent interactions with Taiwan – showcased UAVs integrating AI systems, stealth-oriented designs, and extensive use of carbon-fiber composite materials, such as the “Fury” drone, developed to support fifth-generation fighter “loyal wingman” concepts.

As noted in their review of the event, lessons drawn from the war in Ukraine and recent conflicts in the Middle East have highlighted that unmanned platforms are no longer primarily reusable assets, but increasingly function as expendable munitions for one-way attack missions. As a result, the ability to mass-produce systems quickly and at low cost has become a critical factor.

In the small- and medium-sized UAV segment, trends include the use of 3D-printed modular components, simplified operating procedures, and designs that allow operators with minimal training to deploy systems rapidly. These developments reflect the growing emphasis on low-cost, attritable unmanned capabilities

In response to demographic challenges such as declining birth rates, many exhibitors also showcased solutions aimed at maximizing manpower efficiency and reducing training costs. Virtual-reality–based training simulators and more intuitive, human-centered control interfaces were notable highlights of the exhibition.

By Nazrin Sadigova