What Red Sea disruption means for global supply chains

Analyzing the current situation around the Red Sea, Geopolitical Futures concludes that it is far from business as usual for global shipping. Caliber.Az reprints the article.

The Red Sea is a vital waterway for commercial shipping that connects markets in Europe, Asia and Africa. In recent weeks, however, it has been the site of multiple attacks launched by Yemen’s Houthi rebels in support of Hamas in its war with Israel. The group claims to target only ships leaving from or going to Israel, but others with no clear Israeli connections have been attacked while sailing through the sea. On Dec. 18, the U.S. announced that it would set up a task force to strengthen security in the area. But as Washington calls for more governments to contribute to the effort, the Houthis say the attacks will continue.

The Red Sea is a sort of junction between the Indian Ocean and the Mediterranean Sea that separates the Arabian Peninsula from the Horn of Africa. It’s connected to the Indian Ocean through the Bab el-Mandeb strait, one of the most critical chokepoints in the world. Three countries occupy the coastline along the strait: Eritrea, Djibouti and Yemen. Djibouti hosts military bases from several foreign countries, including the United States, the United Kingdom, China and Saudi Arabia, while Eritrea maintains close ties with China and Russia. (It voted recently against a U.N. resolution to stop the conflict in Ukraine.) Yemen, meanwhile, is engulfed in a brutal, eight-year war between the internationally recognized government, supported by a Saudi-led military coalition, and the Iran-backed Houthi rebels.

In 2014, Houthi insurgents overthrew Yemen’s government. The following year, the Saudis led a coalition of mainly Gulf Arab states to oust the Houthis – which was ultimately unsuccessful. The country has remained divided ever since, with the Houthis controlling much of the north, the government holding the seat of power from the southern city of Aden, and several other armed factions pursuing their own agendas. Peace negotiations have been held but have so far failed to result in a deal.

Iran’s partnership with the Houthis, including its supply of weapons, has grown deeper since 2014. But this isn’t a typical patron-client relationship. The Houthis are financially self-sufficient, earning revenue through taxation, customs charges and service fees, as well as smuggling operations. They’re seeking international recognition as a legitimate military and political force in Yemen – a goal they can’t accomplish solely with Tehran’s help. Yet they’re undeniably a proxy of the Iranian regime, which has supported them throughout the Saudi-led campaign. The group is thus an unpredictable force and major source of uncertainty, especially since the war in Israel began.

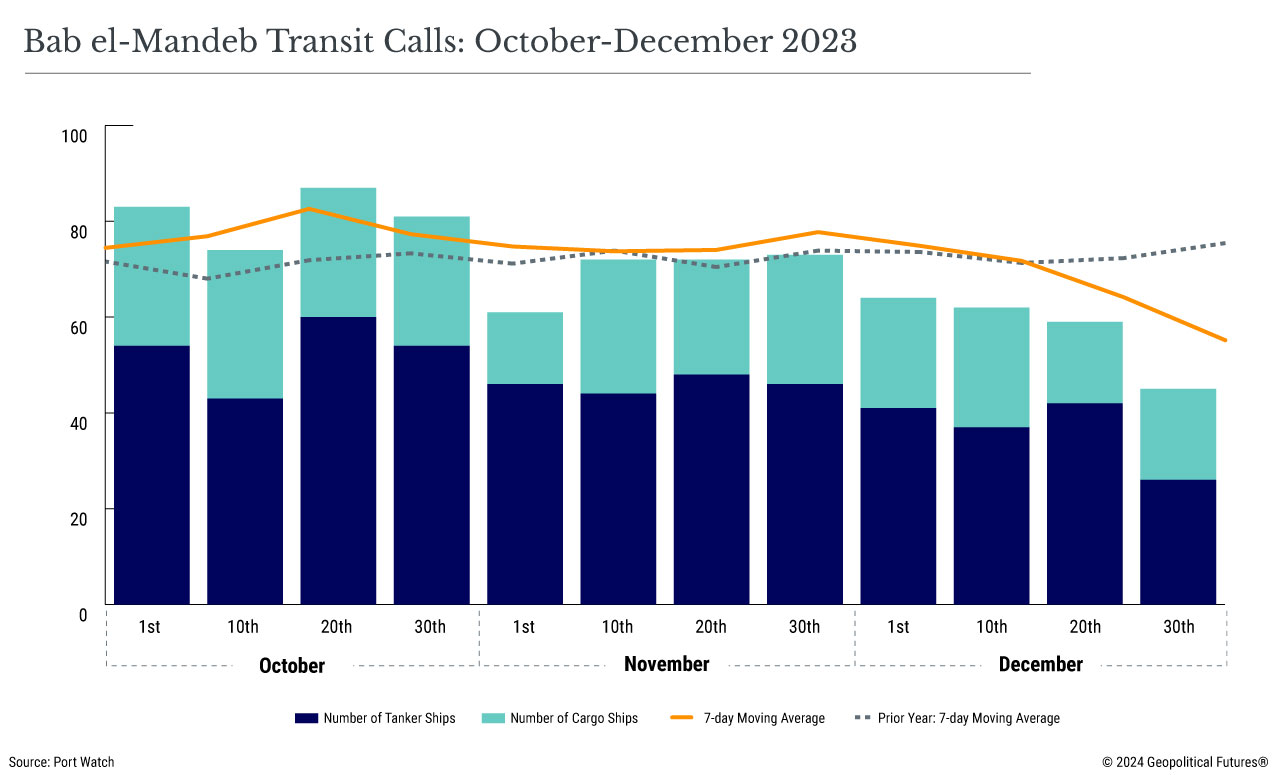

The danger to shipping through the Red Sea adds another layer to global economic challenges in 2024. An estimated 10-12 percent of global trade passes through the sea. While the Bab el-Mandeb lays on its southern tip, the Suez Canal sits on its northern edge as a pathway to the eastern Mediterranean. The 120-mile-long (190-kilometer-long) artificial waterway runs along the Isthmus of Suez, a small strip of land that connects the African and Asian continents. Approximately 14 percent of global oil exports pass through the canal, while more than 30 percent of global container traffic is conducted through the Red Sea.

Since the Houthi attacks began, some ships have tried to broadcast their neutrality in an effort to pass safely through the route. Others are now avoiding the area altogether. Oil giant BP recently stopped all Red Sea shipping operations. European shipping companies Hapag-Lloyd and MSC, as well as Japanese shipping firms Mitsui O.S.K. Lines and Nippon Yusen, are also avoiding the sea. On Tuesday, Denmark’s Maersk announced that it would divert its container ships away from the Red Sea following an attack over the weekend on one of its vessels – though it had said late last month that it would resume transit through the region after the U.S. announced the establishment of a naval force to protect commercial shipping. France’s CMA CGM said on its website that it would increase its container shipping costs from Asia to the Mediterranean region by up to 100 percent as of Jan. 15 compared to Jan. 1.

Either way, international shipping has taken a hit, fueling new concerns over the global economy. The most obvious worry is that the situation could cause a spike in energy prices, given that the region is a major exporter of oil to markets around the world. According to S&P Global, 24 percent of the vessels redirected from the Suez Canal since Dec. 15 were crude oil tankers. Bulk carriers accounted for about 35 percent and container ships were another 24 percent.

Approximately 90 percent of the oil that flows through the Bab el-Mandeb comes from the Persian Gulf and is destined for Europe and Africa. The other 10 percent is oil from the Horn of Africa. The Red Sea is also a transit route for roughly 80 percent of Russia’s petroleum destined for Asian markets and 8 percent of the global liquified natural gas trade. In the first 11 months of 2023, 42 percent of Russian-loaded crude and products traveling through the Red Sea.

However, the situation isn’t as problematic for Moscow as it may appear; none of the attacks in December targeted Russian shipments, and Russia will benefit from the increased oil prices that will likely result from higher transport costs. The price of carrying oil through the Red Sea has jumped by about 25 percent, while the alternate route along the Cape of Good Hope is not just longer but also 10 percent more expensive than before the attacks. One industry analyst estimates that rerouting vessels destined for Europe from the Red Sea to the Cape of Good Hope could raise shipping costs by 80 percent.

Europe stands to lose the most from higher energy prices. As it tries to transition away from Russian energy, it’s relying more heavily on LNG. Most of the LNG flowing through the Bab el-Mandeb and the Suez Canal is headed for Europe. The good news so far is that Qatari LNG supplies to Europe continue to pass through the Red Sea and Suez Canal without any diversions. European gas prices increased by more than 10 percent after BP ceased shipments via the Red Sea on Dec. 18, but prices have declined since then. European underground gas storage facilities are now 97.89 percent full, and the winter so far has been mild. However, the situation is still fluid as the Houthis continue to launch more assaults.

Supply chains for other sectors have also experienced disruptions. Given that the Red Sea is used for transporting commodities and other resources between large markets, disruptions in traffic here can have serious economic effects. This is especially the case at the moment because a severe drought has reduced traffic via the Panama Canal, causing U.S. grain shipments destined for Asia to take lengthy detours through the Suez Canal and southern Africa. The number of vessels passing through the Panama Canal daily has fallen by nearly 40 percent, resulting in significantly longer wait times – and longer journeys, which directly influences freight costs and product pricing.

The Panama Canal Authority said on Dec. 15 that it would increase daily transit through the canal from 22 vessels to 24 in January due to increased rainfall and water levels. But even this figure is well below normal volumes. Rerouting though the southern tip of Africa is also costly. A ship traveling from Asia to Europe via the Suez Canal would require an extra 15 days to make the journey via the Cape of Good Hope, plus additional time to navigate new operational costs, insurance and legal frameworks.

Shipping companies are now not only diverting their vessels from the Red Sea but will likely have to renegotiate insurance contracts due to the added risks. The lengthy alternate journeys are straining shipping capacity during the peak shipping season for U.S. grain – most of which was traveling through the Panama Canal but is now also rerouted because of the drought – aggravating the situation even more. The uncertainty will undoubtedly translate into higher costs and, if this continues, even higher inflation. It’s also exacerbating the global supply chain disruptions that were already in effect throughout last year, making calls for deglobalization even louder.