Media: Trump’s Venezuela oil revival plan could cost $100 billion

President Donald Trump’s plan for a US-led revival of Venezuela’s struggling oil industry could take years and cost more than $100 billion, analysts say.

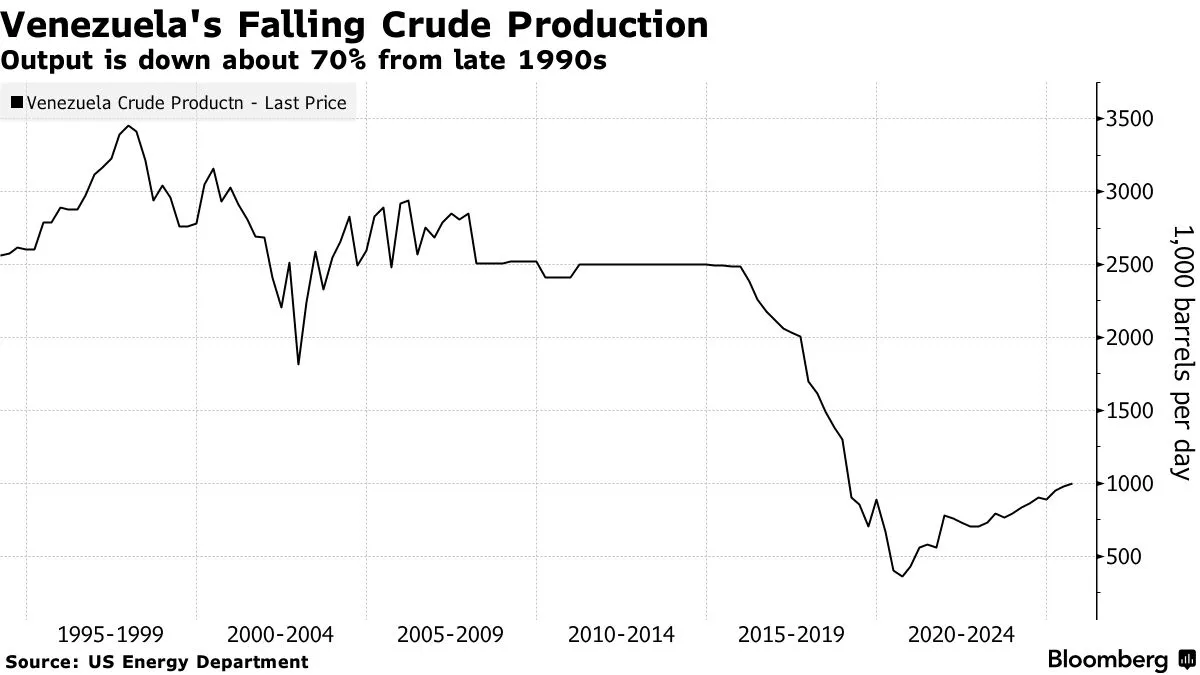

Decades of underinvestment, corruption, and theft have left Venezuela’s crude infrastructure in disrepair, and restoring output to its 1970s peak would demand massive investment from international oil firms, Bloomberg reports.

Francisco Monaldi, director of Latin American energy policy at Rice University’s Baker Institute, estimated that companies such as Chevron, Exxon Mobil, and ConocoPhillips would need to invest around $10 billion annually for the next decade.

“A faster recovery would require even more investment,” Monaldi said.

Venezuela holds the world’s largest oil reserves, but production plummeted during Nicolás Maduro’s 12-year presidency. The country now produces roughly 1 million barrels per day, compared to nearly 4 million barrels in 1974.

US Secretary of State Marco Rubio expressed optimism about American firms’ interest in Venezuela’s heavy crude. “I haven’t spoken to US oil companies in the last few days, but we’re pretty certain that there will be dramatic interest,” Rubio said. “I think there will be tremendous demand and interest from private industry if given the space to do it.”

However, political stability remains a concern. Lino Carrillo, a former manager at state oil company Petroleos de Venezuela SA, cautioned that companies will need a functioning congress or National Assembly before committing. “For any oil companies to actually get serious about investing in Venezuela would require that there will be a new congress or National Assembly,” Carrillo said. “Not what’s happening now. Definitely not.”

The challenges are vast. At Venezuela’s oil ports, equipment is so degraded that fully loading supertankers can take up to five days, compared to one day seven years ago. In the Orinoco Basin, rigs have been abandoned, and oil spills go unchecked. Pipelines are leaky and sometimes stripped for scrap. Fires and explosions have destroyed equipment, and the Paraguana refining complex operates intermittently and at low capacity.

Chevron is currently the only major US company operating in Venezuela, accounting for about 25% of the country’s production under a special licence that allows it to operate despite US sanctions. Exxon and ConocoPhillips, which previously worked in Venezuela before their assets were nationalised, have yet to commit to returning.

Exxon has indicated it would invest under the right conditions. Chevron said it is “focused on the safety and well-being of its employees and the integrity of its assets in Venezuela. We continue to operate in full compliance with all relevant laws and regulations.”

It remains unclear how Venezuela’s political transition will unfold. Sanctions remain in place, and a US naval blockade controls the surrounding waters. Trump has said Vice President Delcy Rodriguez is now in charge, although she is a close ally of Maduro.

“I expect oil companies will start the work of updating plans and proposals for their participation — but won’t make commitments until basic political stability looks forthcoming,” said Clayton Seigle, senior fellow at the Centre for Strategic and International Studies in Washington.

Trump’s administration is evaluating Western oil companies’ interest through the National Energy Dominance Council, chaired by Interior Secretary Doug Burgum and vice-chaired by Energy Secretary Chris Wright.

Global market conditions add further uncertainty. Oil prices are near a five-year low, and some companies are still owed billions after asset seizures under Chavez. However, analysts believe major firms may return if the price and risk premiums are favourable.

“You’re going to need good terms to get around heroic uncertainty,” said Kevin Book, managing director at ClearView Energy Partners. “The kinds of companies that are capable of profitably producing resources in Venezuela are unlikely to ignore the size of the reserve opportunity if they can see signs of relatively stability and they can secure favorable contract terms.”

By Aghakazim Guliyev