What does energy mean for the Russia-China partnership? Shifts amidst the Ukrainian war

As the Russo-Ukraine war rages on with the Ukrainian forces effectively intervening in the Russian Kursk region, Moscow finds itself in a harsh dilemma and limited diplomatic space for maneuvering. Due to its isolation from the West, Moscow is now focused on its immediate neighborhood by boosting trade, economic, logistics, and energy partnership. The continuous partnership in these spheres would ensure Russia’s long-term leverage in the region despite its steady decline since February 2022.

In this sense, Russia's main strategic ally and partner is indeed China. For many years, China has been Russia's main partner in nearly all fields, including security and military-technical. This pillar of partnership strengthened significantly since Russia's military intervention in Ukraine in 2022, and China became Russia's main defense component supplier, though it refuted all allegations and criticism from the West. However, the Russia-China partnership has its own limitations, particularly in the energy field.

Russia is China’s long-term main natural gas supplier through its Siberian Power pipeline. Given the positive dynamics, Moscow and Beijing in 2018 agreed to construct the Siberian Power-2 pipeline. In May 2024, during Vladimir Putin's official visit to Beijing, both sides agreed to start work on the proposed pipeline as Russian energy exports to Europe have fallen precipitously. Although Russia has been able to redirect most of its oil and coal exports to other markets, it has been unable to do so with natural gas due to a lack of infrastructure linking its western production basins to consumers in Asia.

However, it appears those plans have been put on hold. A recent decision by Mongolia’s government not to include funding for pipeline construction in a five-year economic plan is widely seen as an indicator that China is rethinking the pipeline project. The proposed pipeline is supposed to carry an additional 50 billion cubic meters of Russian gas to China via Mongolia, thus providing Moscow with much-needed revenue. Seemingly, the costs of the Siberian Power 2 pushed China to seek alternative options, such as a new pipeline from Turkmenistan. The Mongolian section, which was supposed to cover a significant part of the pipeline’s route, is now in question. Moreover, the possibility of Russia strengthening its influence in Mongolia in the long run might have alarmed Beijing, mainly if Gazprom were to take unilateral control of this section.

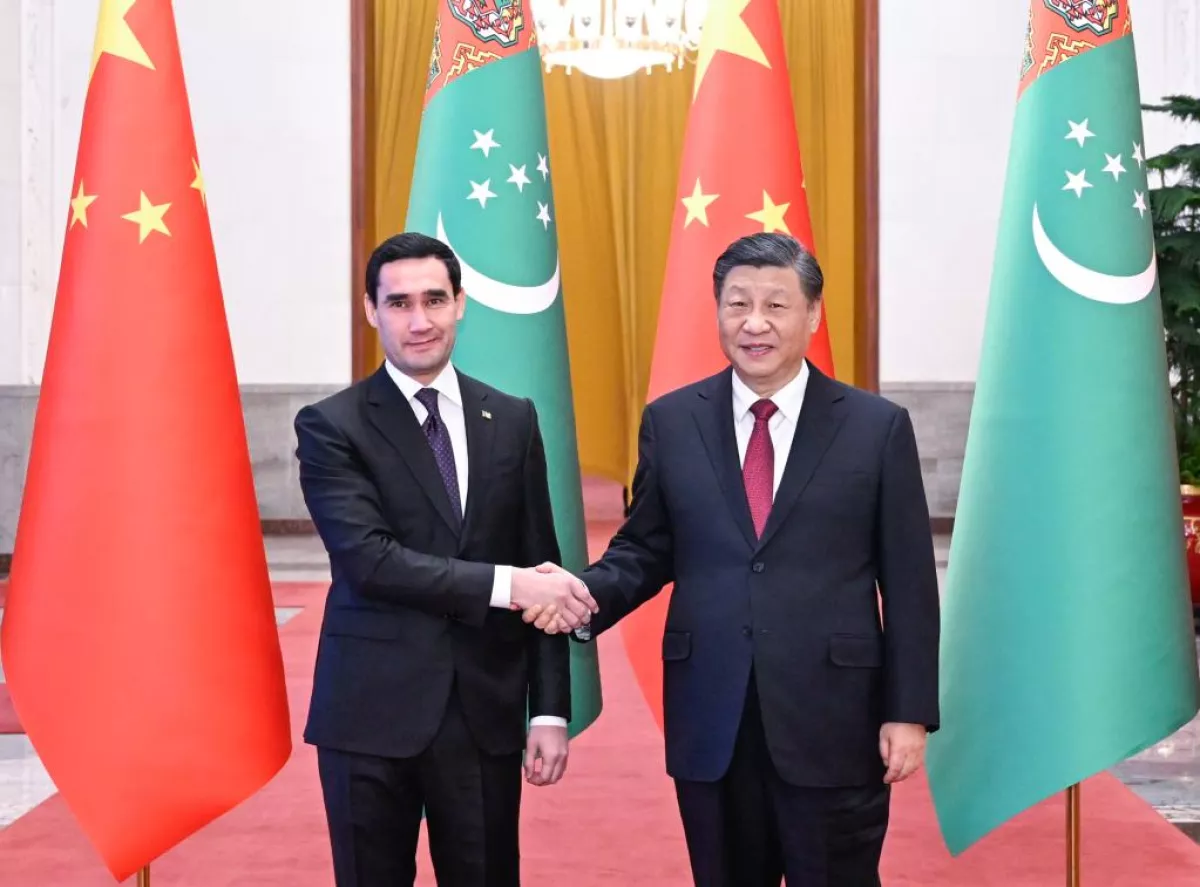

In this case, China would maintain greater control over such a pipeline during both the construction and operational phases. Considering the strong leverage of China over Turkmenistan, it could favor Ashgabat over Moscow. Turkmenistan occupies a unique position in Central Asia as the lone state in the region, enjoying a trade surplus with China. Central Asia has turned into one of China's leading providers of natural gas over the last two decades, while Beijing has invested billions of dollars in infrastructure projects to make the region a pivot of its geopolitical aspirations. However, in early 2024, Russia, for the first time, overtook Turkmenistan on a monthly basis to become the largest pipeline supplier of natural gas to China. Nonetheless, trade turnover in 2024 between Ashgabat and China totaled almost $2.6 billion, including natural gas. Moreover, in the March-July 2024 period, Turkmenistan exported $5.67 billion in natural gas to China, outpacing Russia.

Consequently, the Russia-China energy partnership has declined since the war erupted in 2022. This is partly because of Beijing's kinship to keep its distance from Russia due to the risks of being sanctioned by the West and Russia’s limited economic abilities to increase trade turnover with China. Hence, Russia is preparing for an extended period of international isolation and transitioning to a wartime economy, which supports large-scale, state-funded infrastructure projects.

On the other hand, international sanctions nearly collapsed Russia’s gas giant Gazprom's annual revenues, leading to vast financial losses. China's potential unwillingness to continue the work on Siberian Power 2 would, therefore, pose an existential threat to Gazprom, thus paving the way for its domestic competitor Rosneft's rise as a new energy monopolist.