Nakhchivan’s economic reset Fiscal incentives, corridors, and renewable energy

Over the past three years, Azerbaijan’s Nakhchivan Autonomous Republic (NAR) has been undergoing extensive administrative and economic reforms aimed at fostering a favourable business environment and boosting non-oil production. Two strategic initiatives are already underway in the region: developing a regional transport hub and building capacities for the production and transit of renewable (“green”) energy.

Starting January 2026, a comprehensive package of tax and customs incentives—valid for 10 years—has come into effect. These measures are designed to make Nakhchivan an attractive destination for investors and to stimulate the growth of industrial, agricultural, mining, and other enterprises with high export potential.

Since late 2022, the autonomous republic has been undergoing comprehensive reforms in government structures, legislation, and personnel, aimed at driving large-scale economic transformation. A major milestone in this process was the approval of the State Programme for the Socio-Economic Development of the Nakhchivan Autonomous Republic for 2023–2027 by President Ilham Aliyev in June 2023.

The measures implemented since then have enhanced fiscal transparency, improved the business and investment climate, formalised labour relations, and strengthened efforts to reduce bureaucratic delays. This initial phase of reforms has established a modern legislative and administrative framework designed to attract investment, expand export-oriented value chains, and increase permanent employment in NAR, which today has a population of around 470,000.

The effectiveness of these reforms is evident in the statistics. The NAR budget for 2026 has been approved at 483.178 million manat (approximately $284 million), a 30.9% increase compared to the previous year. This growth is partly driven by a more than 60% rise in the number of small and medium-sized enterprises (SMEs) over the past two years.

The expansion of the private sector is also boosting tax revenues in the region: from January to October 2025, payments from the non-state sector totalled 147.6 million manat (around $87 million), a 22.9% increase. Investment activity is likewise on the rise. According to the State Statistical Committee, 118.4 million manat (roughly $70 million) was directed to fixed capital between January and July 2025, representing a 45.9% year-on-year increase.

In addition, the NAR Ministry of Economy’s Entrepreneurship Development Fund provided 12 million manat (about $7 million) in concessional loans during the first three quarters of 2025 to support 123 investment projects. This reflects a 4.9-fold increase in the number of projects and a 4.3-fold rise in concessional loan amounts compared to previous periods.

Business and investment activity, along with the growth of SMEs, helped Nakhchivan’s GDP increase by 3.6% over the first 11 months of 2025, while industrial output during the same period rose by more than 14.1%. In the first three quarters of the year, NAR enterprises exported products worth $10.3 million, a 29.8% increase. Beyond traditional deliveries to neighbouring countries, new markets were also explored, including the USA, UAE, Iraq, Syria, and Tajikistan.

These developments reflect significant qualitative changes in the autonomous region’s economic system. Yet, Nakhchivan’s untapped potential still far exceeds these figures. Over the past two decades, around 440 industrial and processing enterprises have been established in NAR, producing more than 350 types of products, mostly agricultural. However, due to logistical challenges and the high costs of long-distance transportation, many operate at only half capacity, and exports still account for less than 10% of agro-industrial output.

To build a robust export-oriented value chain, Nakhchivan urgently needs access to larger markets and, critically, the inflow of foreign investment, advanced equipment, and know-how to produce high value-added goods. The region has particularly strong potential in construction materials production and the extraction of non-ferrous and precious metals. Twenty-one ore deposits have been explored — including molybdenum, polymetallic, arsenic, and gold — along with high-quality rock salt, mineral water sources, and hydrocarbon water deposits. Nevertheless, the current pace of mineral extraction and processing remains far below NAR’s full potential.

The State Programme for the Socio-Economic Development of the Nakhchivan Autonomous Republic for 2023–2027 envisages the creation of several new enterprises in the region, particularly in agricultural processing and packaging. Planned projects include meat and dairy plants, canneries, fruit and vegetable processing workshops, dried fruit production facilities, and wineries. The programme also aims to localise sugar and starch production, develop leather and wool processing, and establish factories producing containers and various types of packaging.

To date, 57.1 million manat (approximately $33.6 million) has been allocated under the State Programme. However, implementing the full range of initiatives will require significantly larger investments, including foreign capital. To address these challenges, Azerbaijan is drawing on international experience in developing exclaves, introducing special tax regimes and eliminating customs duties on imported equipment and raw materials.

Similar fiscal incentives for entrepreneurs in geographically isolated regions exist worldwide, including in Alaska (USA), the Hong Kong Special Administrative Region, Oman’s Musandam Peninsula, the German exclave of Büsingen, the Italian enclave of Campione d’Italia, and Russia’s Kaliningrad region. Such measures help offset the disadvantages of geographic isolation and enhance the investment attractiveness of exclaves.

The preferential scheme, tested in various countries around the world, has been introduced in Nakhchivan since January of this year, using the taxation features and exemptions applied in Azerbaijan’s de-occupied territories.

“From 2026 and for a period of 10 years, entrepreneurs operating in Nakhchivan will receive tax, customs, and social incentives,” said Jeyhun Jalilov, the Presidential Representative in NAR. “These preferences will create additional motivation for entrepreneurs in the autonomous republic, make an important contribution to creating new jobs, and expand production and export opportunities.”

Specifically, legal entities and individuals in the autonomous region will be exempt for 10 years from profit (income) tax, property and land taxes, and the simplified tax. For the same period, dividend income of shareholders (participants) in legal entities resident in NAR will also be exempt from taxation.

In addition, imports of raw materials and supplies for production, research, and development activities are exempt from VAT and customs duties for legal entities and individual entrepreneurs who have received an investment incentive certificate and are residents of industrial or technology parks located in the Nakhchivan Autonomous Republic.

The new fiscal incentives have arrived at a particularly opportune moment: the autonomous republic is on the cusp of a major investment surge driven by the development of renewable energy sources (RES). At present, renewables account for 44% of Nakhchivan’s installed capacity and 48% of its electricity production, well above the national average.

The region’s long-term strategic goal is to establish a “green” energy zone and attract foreign investment to develop wind and solar power capacities totalling 1,500 MW, with plans to export at least 1,000 MW of electricity to Türkiye and Europe.

In the next one to two years, NAR will see the commissioning of the Ordubad Hydroelectric Power Plant (36 MW) and the Tivi HPP (15.6 MW), while two solar power plants with a combined capacity of around 530 MW are nearing completion. Construction is also underway on key substations, including “Nakhchivan” (110 kV), “Babek” (154/110/10 kV), and “Cheshmebasar” (110/35/10 kV). In parallel, a 400 kV export power line connecting Nakhchivan to Türkiye is being laid, and a high-capacity SCADA control centre is planned to manage the region’s energy network.

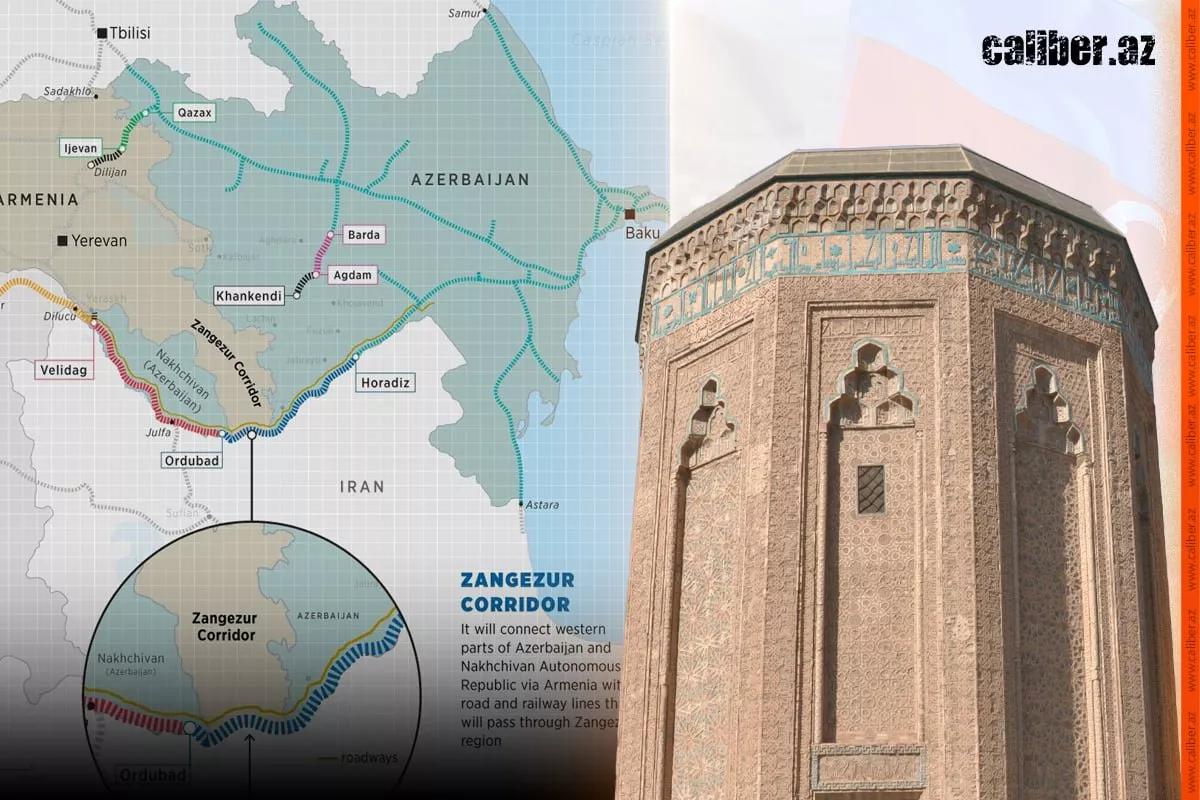

Another key investment direction for Nakhchivan’s development lies in projects aimed at establishing a regional transport and logistics hub. According to Rovshan Rustamov, Chairman of JSC “Azerbaijan Railways” (ADY), the design work for the reconstruction and modernisation of the Nakhchivan section of the Zangezur Corridor railway, 188 km in length, has already been completed. Construction has begun at the border with Armenia, specifically at the Salammelik station in the Ordubad district.

As the TRIPP project in Armenia progresses, and with the connection of NAR’s railway infrastructure to Türkiye via the under-construction Kars–Iğdır–Aralık–Dilucu line (224 km), the rail freight handling capacity of the autonomous region is expected to reach 15 million tonnes within a few years. Moreover, through the Julfa railway hub, exporters in Nakhchivan will gain a shorter and cheaper route to Iranian ports on the Persian Gulf.

Equally important, the transport unblockade will help overcome NAR’s economic isolation, expanding the export potential of local enterprises and reducing delivery costs for over 1 million tonnes of goods transported annually from other regions of Azerbaijan to Nakhchivan.