Turkmenistan – China energy partnership in Central Asia Major change?

Since the shift in the global energy map in Eurasia, Russia, as the leading energy exporter, has turned to the East to boost its influence and explore new markets. This strategic move is aimed at compensating for the financial losses in the West. The main destinations for Russian fossil fuels are India, China, and Central Asian countries, a shift that has enabled Russia to double its annual revenues. In terms of energy monopoly, China remains Russia's main competitor, with Beijing being the main energy client of nearly all Central Asian states.

This changing energy dynamic in Central Asia has significant implications for global energy markets, a fact that cannot be overlooked.

The strategic significance of Turkmenistan is that it is the world's leading natural gas producer with the fourth-largest gas reserves. Despite its potential for diversification, the country has maintained a steadfast energy portfolio, with Iran, China, and Russia as its top clients. In 2023, Turkmenistan produced over 80 bcm of natural gas and more than 8 million tons of oil, with a significant portion flowing to China. However, due to international uncertainties, regional instability, and economic challenges, Turkmenistan has shifted its focus to exporting more gas to China, a move that underscores the strategic importance of its energy trade relationships.

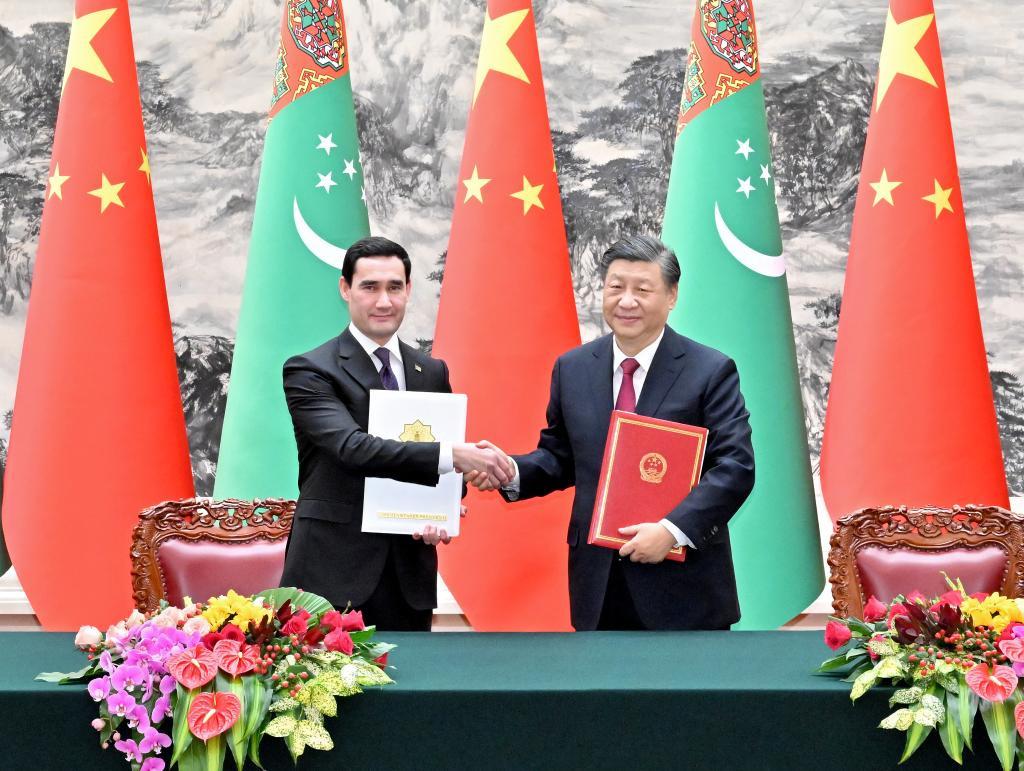

Thus, between January and March 2024, Turkmenistan exported $2.4 billion worth of natural gas to China. The latest known values show that Turkmenistan exported $8.82 billion worth of natural gas to China from January through November 2023. Turkmenistan supplies its gas to China through three gas pipelines, passing through Uzbekistan and Kazakhstan before reaching China. The total capacity of these pipelines is 55 billion cubic meters of gas per year. The network of these pipelines is dubbed the Central Asia – China pipeline. In October 2023, China’s President Xi Jinping called for enhancing the China-Turkmenistan comprehensive strategic partnership, having already pushed to speed up building the Central Asia-China pipeline's final leg.

The Central Asia-China pipeline is a network of gas pipelines that transport natural gas from Central Asian countries – primarily Turkmenistan, Kazakhstan, and Uzbekistan – into China, underscoring its significance in regional energy dynamics. The ongoing construction of the fourth pipeline, extending from Turkmenistan to Xinjiang, is expected to increase the network’s total annual capacity to 85 bcm. Despite its importance, the Line D construction has been delayed due to technical and political issues for a decade.

With the start of Line D, China got a chance to level up its presence in Central Asia even more. However, Russia cautiously watches the deepening energy ties between China and Central Asian nations, particularly with Turkmenistan. As such, Moscow's recent push to land its second Siberia pipeline connection with China, the Power of Siberia 2, to make up for shrunken sales in Europe due to the Ukraine crisis, provides Beijing a lever to advance the Central Asian project. The pipeline project closely aligns with Beijing's foreign policy ambitions of establishing a permanent footprint in the immediate neighborhood. Indeed, the energy factor is another crucial element of Chinese influence in Central Asia as the country increased direct investment in five Central Asian countries up to US$15 billion, an increase of more than 40 percent.

A number of large-scale projects have been successfully implemented, helping Central Asian countries to upgrade their industries, connect with each other, and improve people's livelihoods.

In early 2024, Russia’s energy giant Gazprom announced that it had overtaken Turkmenistan as China's largest natural gas supplier in terms of volume. The volume-earnings differential is because China is hoovering up Russian gas at bargain basement prices. The Kremlin's need for cash to keep the country afloat while maintaining its war effort in Ukraine has deprived Russia of most of its negotiating leverage in its dealings with Beijing.

Looking ahead, Turkmenistan, with its vast potential and reserves, has expressed a willingness to develop energy exports westwards, primarily through the Trans-Caspian pipeline. This shift in export intentions is not expected to impact Turkmenistan’s ability to fulfill existing export commitments to China. The Central Asian state is believed to have more than enough reserves to send large volumes of gas eastward and westward. These potential future developments in the energy sector in Central Asia hold promise and anticipation for the region and beyond.

Nevertheless, Turkmenistan's reserves are too significant to allow them to flow westward. Therefore, Russia and China are expected to pressure Ashgabat to keep it in their sphere of influence.